IDFC Private Equity, one of the first funds to invest in infrastructure companies in India, recently raised its third fund of $700 million. Luis Miranda, President & CEO of IDFC PE, did not have to sweat it out this time to get the dollars in. He achieved the feat in a little over a month after they formally opened the fund to subscription. Contrast this with 2002, when Miranda had to run from pillar to post to raise his first fund. At that time, nobody believed that investing in infrastructure was financially sustainable. However, even though it took time, Miranda managed to raise $190 million from PSU banks and state-owned insurance firms. In the last six years, Miranda and IDFC PE have come of age as a private equity investor in infrastructure sector with some key exits and returns to show.

Miranda, 46, a chartered accountant by training who also went to the University of Chicago in 1987 to get an MBA, has seen at least two cycles of boom and bust. He started his career in forex sales and trading in Citibank and worked briefly with HSBC before joining the start up team at HDFC Bank in the early 1990s.

He later joined ChrysCapital (then Chrysalis Capital – a venture capital fund). In 2002, he joined IDFC to start their private equity fund. This was at a time when the markets were down. VC Circle’s Vidya Vishwanathan spoke to Miranda about his journey so far.

How did you join HDFC Bank?

Working in a multi-national bank was limiting. The decisions sometimes had no touch with reality in India. It was difficult to increase credit limits or get support for structured transactions. But in 1994 you did not have many options. Professional Indian companies did not pay well and the ones that paid well were not professional. So when Aditya Puri called saying he was going to start an Indian bank, an opportunity to build something came up. I was the third banker to come on board.

What was that experience like and what were the lessons?

In the space of a few months I changed three offices. The main branch was in the old Sandoz office. It had wires running across the floor and there were never enough chairs. We rented steel furniture. I conducted my first training session at the bank under a tree in an old textile mill. There was a lot of entrepreneurial excitement but there was also immaculate planning and execution. The business plan changed from what was originally planned before the team came on board. No one could have imagined what has happened to the bank since then.

In the initial years other banks did better. But when the economy slowed down in the mid-90s, the credit problems at the other banks showed up. While the stock prices of other banks floundered, the HDFC Bank stock went up because of the high credit quality. We had a good IT back-bone, high credit quality and well-defined processes. Many of those banks don’t exist now or have been bought by other banks.

How do those lessons apply to your investing?

How do those lessons apply to your investing?

Like I said – Focus on what is important, i.e. excellent processes and quality. Hire good people. Private equity is a people’s business because we invest in people and their ability to build good businesses.

Investing is like a dating game, where people are on their best behaviour. Therefore it is important to spend time with people to really understand what is going on. When an entrepreneur is busy selling, he or she glosses over a lot of details. We also look at people’s ability to execute within cost and in time. We take our time getting comfortable with people. We also do a lot of reference checks with customers, suppliers and investors.

In 2007, the market went berserk. Stupid ideas were getting funded at crazy valuations. We lost deals because term sheets were getting produced faster and at higher valuations.

You did get lucky with the first fund at ChrysCapital. Spectramind bailed you out…

That is how venture capital works – one spectacular win makes a huge difference. We had a couple of great winners. But the internet companies were good ones – the problem was to do with valuations. Just look at who we sold some of our start-ups to – Monster.com bought JobsAhead, eBay bought Baazee and NIIT bought eGurucool.

There was no doubt that the spaces that you invested in would be changed by the Net. But people were hiring their buddies to be head of finance and marketing…

That was my first stint at investing. It taught me to stick to fundamentals and to not get swayed by sentiment. In 2001, ChrysCapital decided that it made financial sense to focus on PIPE transactions, and this was an excellent strategy at that time. However, I wanted to do more traditional private equity deals and build businesses. So we decided that it was best that we parted ways. I called Deepak Parekh, my old mentor at HDFC, who told me that IDFC had a government mandate to set up an infrastructure equity fund and offered me the job.

What was the first step in raising the fund?

Nasser Munjee headed IDFC at that time. We felt that the markets would force the Government to improve infrastructure. Not many people believed that it was possible at that time. I spoke to large investors overseas and they said that they would never invest in another infrastructure fund. Domestic companies like insurance firms, banks and financial institutions were not interested. We needed to raise a Rs 1,000 crore fund and I went to all the chairmen of banks and got turned down.

What changed?

I decided that there had to be three anchors – IDFC, LIC and SBI. IDFC increased its commitment to the fund. There was a Joint Secretary at the Ministry of Finance, Vinod Rai, who helped us by talking to many of the investors. I felt as if I was in a pinball machine in those days – I used to shuttle between SBI, LIC and IDFC, who were 5 minutes away from each other. I would wait for hours sitting outside various offices because people would not meet me – I, anyway, had nothing much else to do those days, and ego had to be put aside! In those six months I had had chai with everyone from the Chairman to the peon. We spent time understanding the issues and deciding what had to be done. We finally closed the fund when we were at Rs 840 crore.

What returns did you promise when you raised the fund and where are you now?

It was a 10-year fund and we promised an IRR in the mid-teens. We finally did much better.

How much higher? You did exit Leela Hotels under a year and made returns of 100% in that fund…is it 30s or higher?

It was higher … next question?

What did you do differently at IDFC Private Equity?

We did three things. Firstly globally infrastructure funds are treated like project finance. In project finance, people focus on how they will get their money back and are more risk averse. We decided to look at it from a private equity perspective and focus on how to multiply money. We hired guys with private equity experience. There was just one person with infrastructure experience. Secondly, we had to handle the conflict between the life of underlying concessions for infrastructure projects (which ranges from 15 to 50 years) and the life of the fund (10 years). We had to provide economic returns for our investors when we exit before the end of a concession. So we decided to focus on investing in aggregation plays and businesses instead of in single projects.. This was considered to be revolutionary at that time.

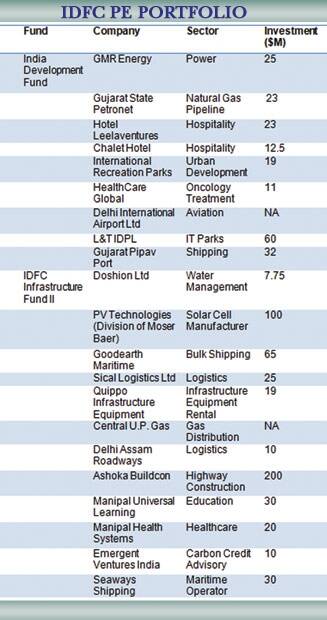

GMR was raising money for their third power plant. We worked with them to aggregate all three plants into one holding company and we invested in GMR Energy, the consolidated company. If the new plant did not come up we would not lose all our money and we could do an Initial Public Offer (IPO) earlier. No one looked at infrastructure investing like that at that time. We clearly were not a traditional infrastructure fund but were going to be a private equity fund investing in infrastructure.

Thirdly, we defined infrastructure the way we wanted to. For us, infrastructure was whatever was a bottleneck in India. And so we invested in education, health and tourism also. We called it social infrastructure. But most of our investments went into hard infrastructure. We have 31 roads, 3 airports and 9 port terminals in our portfolio.

How much time did you take over deals then?

We met the GMR guys in January 2003 at IDFC’s 5th anniversary party and closed the term sheet in August 2003. One of the financial lenders sat for over 3 months on their NOC for GMR to raise equity and the deal got closed finally only in March 2004.

We were very comfortable with Mr. G M Rao, his sons and the team that he had put together. We knew nothing about infrastructure or power at that stage. We learnt about the sector while we worked on the deal. In May 2007 I was invited to a class at my business school at the University of Chicago where Professor Steve Kaplan was teaching a case study on our investment in GMR Energy. One of the students said that one of the key risks in this case was the team because we had no experience in the sector. I told them that because we did not know too much about the sector we did the deal – people who knew about the power sector stayed away. We sold our Rs 100-crore investment in 2004 in the company for nearly Rs 700 crore in 2006.

You also did an airport deal with them in the first fund…

Yes, we were their partners in the bid. We went to our Investment Committee and told them that we had decided to do another investment in GMR and bid along with them since they were the best partner for us.

Were you lucky in your first deal?

Unequivocally yes in regards to the return we made. In hindsight we made the right calls – we invested in good entrepreneurs, we took a PE approach and we invested in aggregation plays. In this case the Vemagiri plant did not get the promised gas supply, a risk that we had identified when he made the investment.

What was your second deal?

Gujarat State Petronet, a 100% government company, was raising private equity. Most funds felt that the government was not commercially minded. I knew the Managing Director since 1994. But the question remained what would happen to the company if he moves. The more the time that my colleagues spent with them, the more they were convinced that that was less of a risk. The team had executed well in the past. The Gujarat Government had passed a legislation, Gujarat Gas Act, which authorised the state government to decide where the pipelines would be laid in the state of Gujarat. But the Central Government filed a case in the Supreme Court claiming that this was a central subject. In the morning of the day that we were taking this deal to our Investment Committee, the Gujarat Government lost the case in the Supreme Court. A US-based fund ran away from the deal. But we knew that once the pipelines were laid they were not going to pull it out.

This is a big advantage that we have – investment decisions get taken in India, and we don’t get swayed what we read in the foreign press or see on CNN. We invested in Gujarat State Petronet and helped with their MIS, governance and their IPO. We were actively involved in their road shows. They have an excellent team and the partnership worked out very well.

The returns from our investments returns hide the problems that we have faced in our portfolio companies. Infrastructure investing is not easy and it has not been an easy ride. In GMR Energy, a power purchase agreement had to be re-negotiated. In the airport bid, the losing bidder filed a case against the government and us. In another company, one of our ships sank and people died – it had a serious impact on our business. Execution risk is a very big risk and many investors seem to ignore that risk.

How did you end up investing in Chalet Hotels?

That is a K Raheja Corp property. They were making a lot of money from their real estate business and didn’t require capital. We would meet them every few months and have the same inane discussion on us investing in them. We would tell them that if they were going to build a couple more hotels then they would not need us. But if they wanted to build 15 or 20, they would need external funds. A year later we invested in them.

While doing the due diligence for this investment, we met Leela Hotels. We did a PIPE deal there even though we usually avoid PIPE investments. We invested in Hotel Leelaventures mainly because they had excellent properties and Capt Nair is a great visionary and also a PIPE investment could give us liquidity within a year after our lock-in got over.

You participated in the Delhi airport bid…

We knew nothing about airports and this was the best way to learn. We were involved in all stages of the bid preparation and even camped out in London with the architects. GMR and us brought in Fraport and Malaysia Airports as partners. We were clearly the underdogs in the race, but GMR was hungry and we won the bid.

About 40% of each of our two funds is invested in transportation.

But there are no airports or roads coming up now…

We are far away from reaching our $500 billion schedule in infrastructure. We have no road, port or airport deals in our deal pipeline. But we have a healthy deal pipeline in other sectors.

Are you going to invest in water or urban local bodies?

A. We have an investment in Doshion Ltd. They are a small company. They came to us thinking that we are the debt arm of IDFC. They were on the verge of closing a private equity fund raising with two other investors. We convinced them to do the deal with us!

Can you talk about other investments?

We have invested in an amusement park and India’s largest mall in Noida. You should take your daughter to visit it – the World of Wonders and the Great India Place. L&T infra was an aggregation play. We started talking to them about it in 2002 and we finally made the investment in 2006. We invested in an oncology hospital in Bangalore because the entrepreneur is passionate and runs it on very strong ethical grounds. He has partnerships with doctors in other centres.

How did you raise your second fund and what were the investments?

Seventy per cent of that fund was subscribed to from overseas. Prime Minister Manmohan Singh was our Chief Marketing Officer for the fund because all he talked about in his early days was the need to invest more in infrastructure! We had a slide with his picture and his quotes on infrastructure. 75% of that fund came from Asia, since Asian investors understood private investing in infrastructure. In the US, infrastructure was looked at as real estate play or a yield instrument.

You invested in Manipal Education out of that fund. Would you send your daughter to do a Masters in Anthropology from Manipal?

There are not enough educational institutions in India. We need to exponentially increase supply. The reservation issue will become irrelevant if we simply increased capacity. It is the much maligned capitation fee IT colleges in the south that were responsible for Bangalore’s IT success.

We wanted to invest in vocational education. A Teamlease report states that 57% of the youth are unemployable – and this is a worrisome statistic. We resumed talks with the Pais of the Manipal Group because we wanted scale. They are an educational institution with a 50-year history. We brought in a new CEO. I have personally spent a lot of time on this investment and the Pais are an excellent partner.

We have started training plumbers, masons and bar-benders in Orissa. We are also training entry-level bankers and retail staff. The team has increased the number of students doing distance education and expanded the overseas campuses. We can say that we have succeeded only when we have impacted at least 100,000 students.

Is there scope in education?

Yes … rural education, vocational education, management education…

We continue to invest in great partners. We invested in a company called Goodearth Maritime. The promoters started off in the commodity business. They then moved into shipping and we are now building a shipyard out in Cuddalore, south of Chennai. We invested $ 65 million and that is our largest investment today.

You have investments in cleantech…

We have made a few investments in this space, like in Doshion. We have invested in Moser Baer’s photovoltaic business since one of my colleagues had invested in them before. They are building world-class manufacturing facilities in Noida and Chennai and are exporting to Europe.

We have also invested in a CDM advisory company, Emergent Ventures.

How much have you raised in the third fund? What will be the focus areas?

Our focus is the same – infrastructure. But competition has picked up with over USD 10 billion of funds being raised to invest in India’s infrastructure. This means that we have to run faster to stay ahead of the pack. We have to look at new areas and at new opportunities. Valuations are still high. A lot of private equity players are going to get burnt badly because they had lots of money and got carried away making expensive investments.

The new fund is a $ 700 million fund and so the deal sizes could increase from $30 million to $50 million.